Top-rated Vendor Fraud & Risk Management Software

Safely onboard new vendors with our secure vendor management platform. Keep your vendor data up-to-date by leveraging our sophisticated cross-matching system with over 3.5 million verified vendors in our database. We'll help make sure you’re paying the correct vendor every time.

See how Eftsure protects your business payments

VENDOR FRAUD PREVENTION

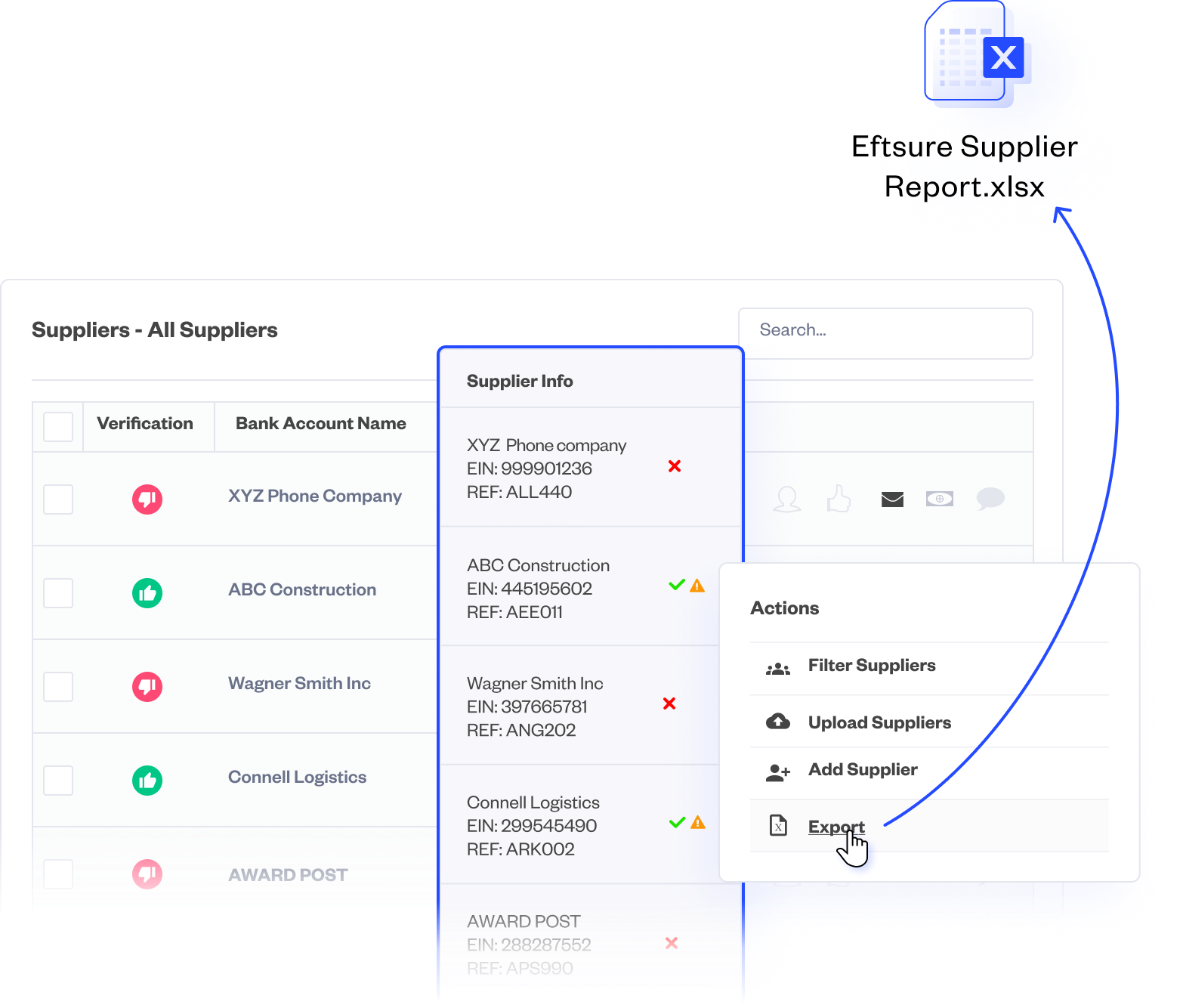

Simplify & automate supplier onboarding

Securely bring new suppliers into your ecosystem. Efficiently keep supplier data up to date and maintain a high-security posture.

- Maintain accurate, up-to-date supplier information verified by third-parties.

- Import existing suppliers to verify business registration, company name, bank account number against our network of verified suppliers

- Automatically verify supplier information during onboarding to ensure secure payments.

.png)

BUILT FOR FINANCE TEAMS

Global Cybercrime Damage Predicted To Hit $10.5 Trillion Annually By 2025.

Finance teams, specifically accounts payable teams, are the key targets for cybercrime. But, without the help of software, it’s always going to be an unfair fight.

Cybercriminals only need to be successful once, whereas finance teams need to be sure about the payment details every time. Eftsure provides peace of mind and confidence in the entire payment lifecycle.

VENDOR MANAGEMENT

Secure vendor management

Our secure portal makes it easy to add or change existing vendor details without risk of error. Vendors are verified using bank-linked data or expert call-back controls.

Trusted by the world's top companies

You’re in good company

FAQ

Eftsure is a leader in fraud detection and payment protection.

Our pioneering fraud-tech solution brings financial controls into the digital age and helps organisations of all sizes mitigate the risk of processing irretrievable payments to scammers.

Our global multi-factor verification platform boasts over 6 million verified businesses. This enables you to verify banking details in real-time before processing payments to your suppliers. This helps mitigate the risk of human error and prevents modern cyber fraud tactics such as social engineering, phishing and fake invoicing from impacting you financially.

In a business landscape where instances of digital fraud are rising exponentially, Eftsure enhances your payments controls and provide you additional peace of mind.

Modern cybercrime and fraud involve identity theft and social engineering to impersonate trading partners and vendors. Vulnerabilities in your supplier or partner organizations can become your problem, allowing fraudsters to deceive you using legitimate email accounts and documents.

These impersonations are hard to detect and fraudsters continually adapt their tactics to bypass most payment controls and AP measures.

A single verification method, like your own records or call-back control, is not enough in this environment. That's why we've developed an approach suited for a digitally connected world: multi-factor verification.

Modern cybercrime and fraud uses identity theft and social engineering (manipulation) to impersonate trading partners and vendors. Vulnerabilities in supplier or partner organisations become your problem, too, by allowing fraudsters to get into their system and deceive you using legitimate email accounts and documentations.

These impersonations make use of legitimate email accounts and are extremely hard to detect. Further, fraudsters constantly adapt their tactics to circumvent most payment controls and AP measures.

A single factor of verification (be it your own records or a call-back control) is insufficient in such an environment. That’s why we’ve developed an approach that’s fit for a digitally connected world: multi-factor verification.