PAYMENT FRAUD PREVENTION

Stop Payment Fraud Before It Happens

Today’s finance leaders are expected to move swiftly, maintain compliance, and mitigate risks—all without compromising efficiency. Eftsure is purpose-built to help you:

- Streamline Vendor Management & Compliance

- Prevent payment fraud

- Eftsure Guarantee – up to $1 million indemnity on verified payments

- Clean up your Vendor Master File

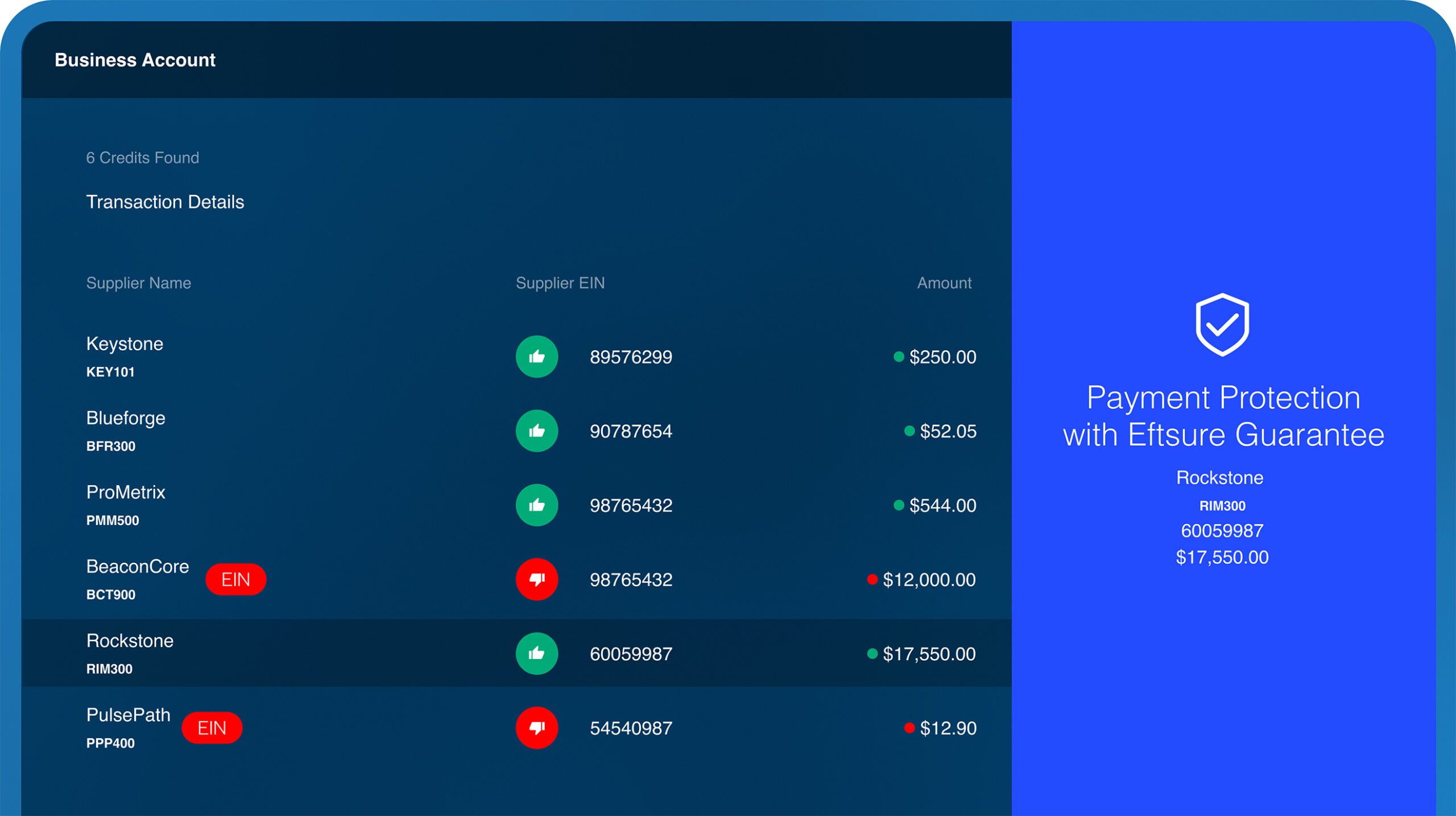

THE EFTSURE GUARANTEE

Up to $1 Million in Protection for Verified Payments

When you pay through the Eftsure platform—whether via ACH or wire—you’re protected by best-in-class digital payment fraud controls and backed by the Eftsure Guarantee.

The Eftsure Guarantee provides indemnity coverage for payment losses caused by social engineering fraud. If a payment marked with Eftsure’s green thumbs-up is compromised, we’ll cover the loss—up to $1 million per customer.

BUILT FOR FINANCE TEAMS

Global Cybercrime Damage Predicted To Hit $10.5 Trillion Annually By 2025.

Finance teams, specifically accounts payable teams, are the key targets for cybercrime. But, without the help of software, it’s always going to be an unfair fight.

Cybercriminals only need to be successful once, whereas finance teams need to be sure about the payment details every time. Eftsure provides peace of mind and confidence in the entire payment lifecycle.

VENDOR RISK MANAGEMENT

All in One Platform

Eftsure gives you a single, secure platform to onboard vendors, manage compliance, and protect every payment.

- Centralised vendor management: Streamline onboarding, approvals, and updates in one place.

- Automated, multi-layered verification: Eftsure validates vendor identity and bank details in real time using fraud detection, business registry checks, bank account matching, and cross-matching against a network of verified vendors.

- Vendor master file clean up: up to 25% of vendor master files contain inaccurate or outdated information. With Eftsure, you can easily audit and cleanse your vendor data.

.png)

Trusted by the world's top companies

You’re in good company

FAQ

Eftsure is a leader in fraud detection and payment protection.

Our pioneering fraud-tech solution brings financial controls into the digital age and helps organizations of all sizes mitigate the risk of processing irretrievable payments to scammers.

Our global multi-factor verification platform boasts over 6 million verified businesses. This enables you to verify banking details in real time before processing payments to your suppliers. This helps mitigate the risk of human error and prevents modern cyber fraud tactics such as social engineering, phishing and fake invoicing from impacting you financially.

In a business landscape where instances of digital fraud are rising exponentially, Eftsure enhances your payments controls and provide you additional peace of mind.

Digital transformation is changing how we do business, but it also brings new challenges, especially the rise in digital fraud. Organizations face unprecedented threats from offshore criminal syndicates aiming to defraud them through hacking and deception.

The risk is highest with payments because banks don't verify the payee’s account name with the EIN or account number. This gap allows criminals to exploit organizations through methods like Business Email Compromise (BEC), Vendor Email Compromise (VEC), hacking ERP systems, and tampering with vendor master files and ACH files used for online banking.

Accounts Payable teams often lack the capacity and training to detect such fraud, and ERP and accounting software can only match new data to existing data, not against an independent source.

Modern cybercrime and fraud involve identity theft and social engineering to impersonate trading partners and vendors. Vulnerabilities in your supplier or partner organizations can become your problem, allowing fraudsters to deceive you using legitimate email accounts and documents.

These impersonations are hard to detect and fraudsters continually adapt their tactics to bypass most payment controls and AP measures.

A single verification method, like your own records or call-back control, is not enough in this environment. That's why we've developed an approach suited for a digitally connected world: multi-factor verification.